Reverse Charge in Invoices

When to apply

We sell a service to a business located in Italy, which is a member state of the EU. Our customer provides us with their valid VAT identification number for invoicing.

We issue our invoice to the customer in France without VAT and with the note "Reverse Charge".

VAT Rule for Invoices

To apply reverse charge to your invoices, you might need to create a separate VAT rule.

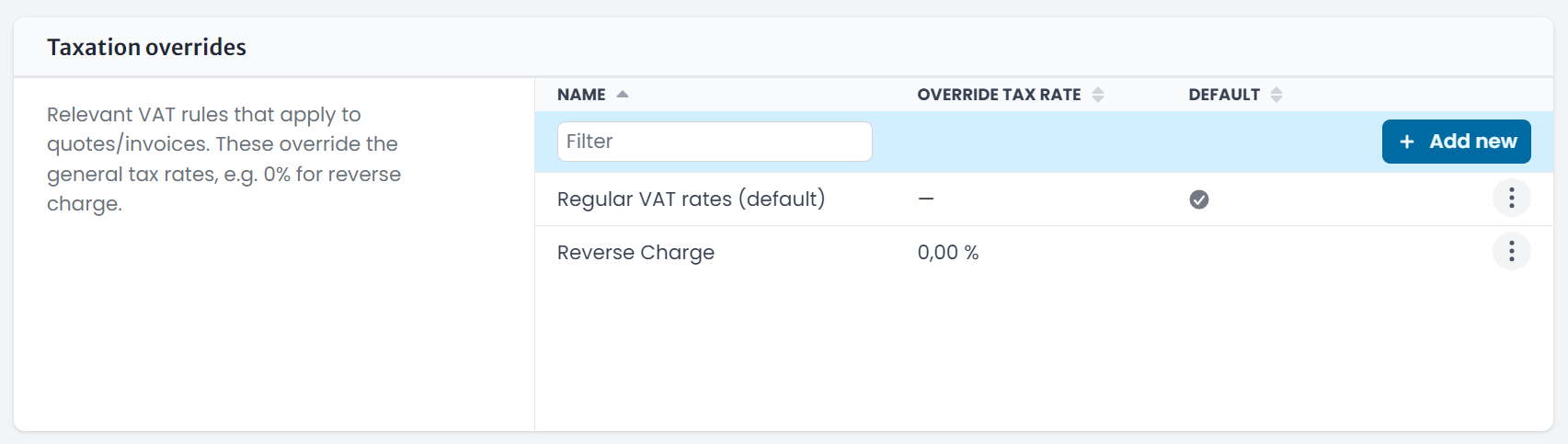

In most cases, you team should already have such a VAT rule in place, as freispace automatically generates it for you. To check whether it exists, navigate to the Team settings, head to the tab Invoicing and scroll down to Taxation overrides.

If you see a rule called Reverse Charge, you don't need to do anything.

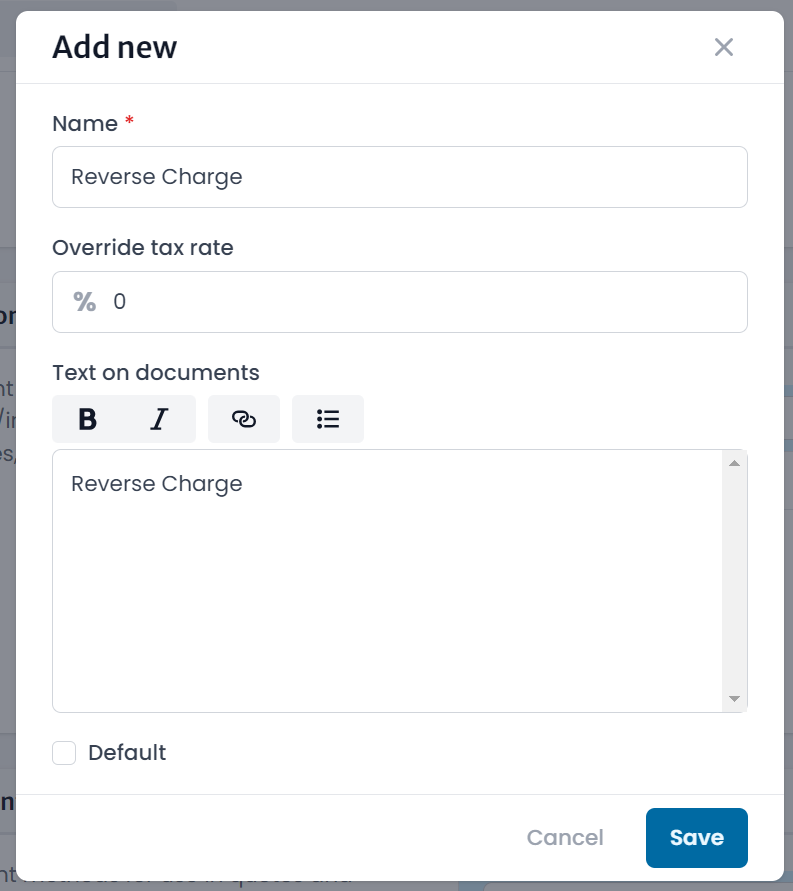

Otherwise, create a new rule by clicking Add new.

Enter Reverse Charge as the Name and Text on documents. For the Override tax rate field, set 0.

Creating Invoices with Reverse Charge

In the invoice, select the aforementioned VAT rule under Additional options.

You are required to list the client's VAT identification number on the invoice. Make sure it's valid.

If you have added the VAT ID in the client's settings within freispace, it will automatically be printed on the invoice. If not, you can add the VAT ID in the Recipient field.